Introduction

Unfortunate circumstances could occur at any given instance — we will never know when we might lose a loved one. At that point of time, many would be at a loss of what to do. On top of enduring emotional grief, executors and administrators have the additional responsibility of settling the deceased’s estate.

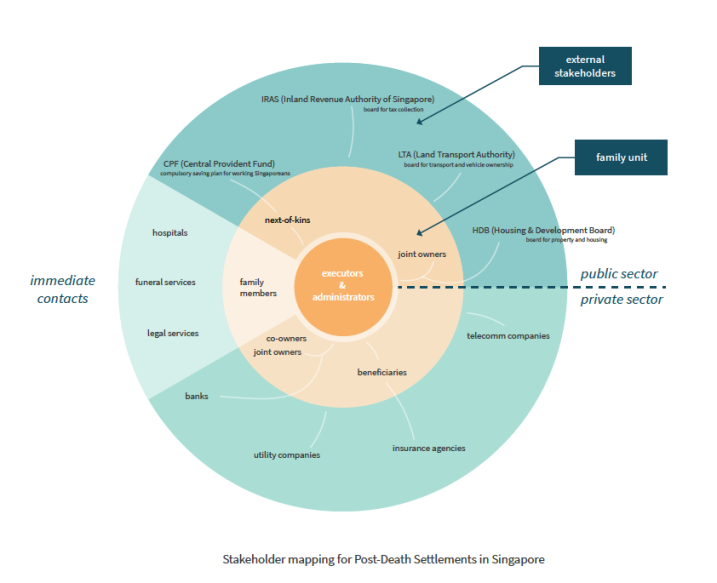

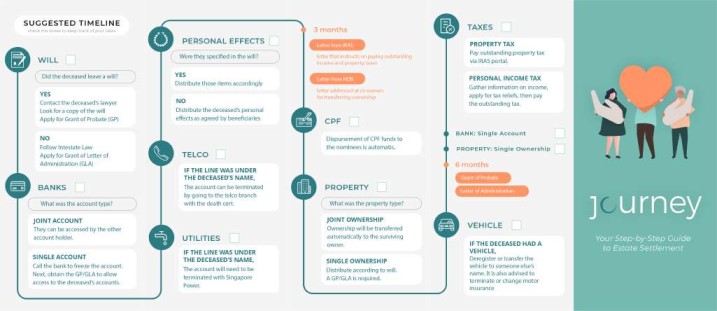

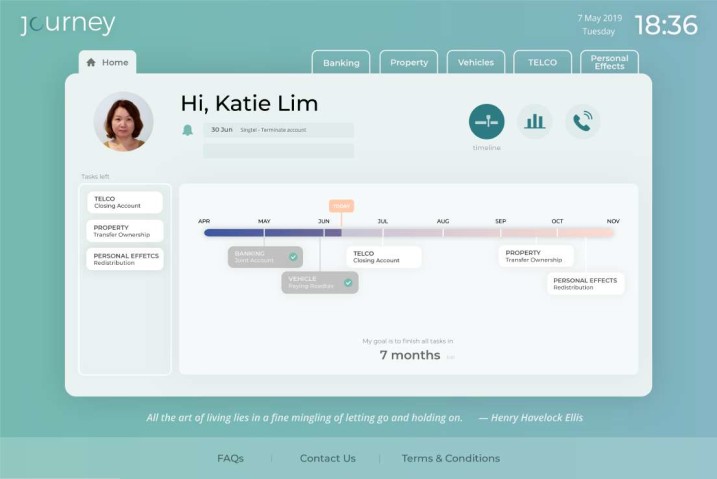

This typically includes matters such as closing or transferring ownership of properties, bank accounts, and other services such as telco and utility accounts. Hence, in Singapore, post death settlements is a complicated process that involves multiple service providers in both government and private sectors.

In order to find out what to do, one has to go through a tedious process: getting information on where to find the will; contacting legal services to get rights of the deceased’s accounts; browsing through wordy, unclear and fragmented sources of information; and calling service providers to clarify vague or unavailable administrative processes.

Furthermore, as most of the actual regulatory work is done manually in Singapore, extra time has to be allocated for visits to the bank or relevant government agencies.

Besides the sheer number of tasks, executors usually have no guidance or point of reference when it comes to estimating how long these processes will usually take, or how to properly plan for such scenarios. To make matters even worse, they would have to do this while navigating their own grief, and the sensitive nature of talking to family members about the financial matters or practical concerns after losing a loved one.

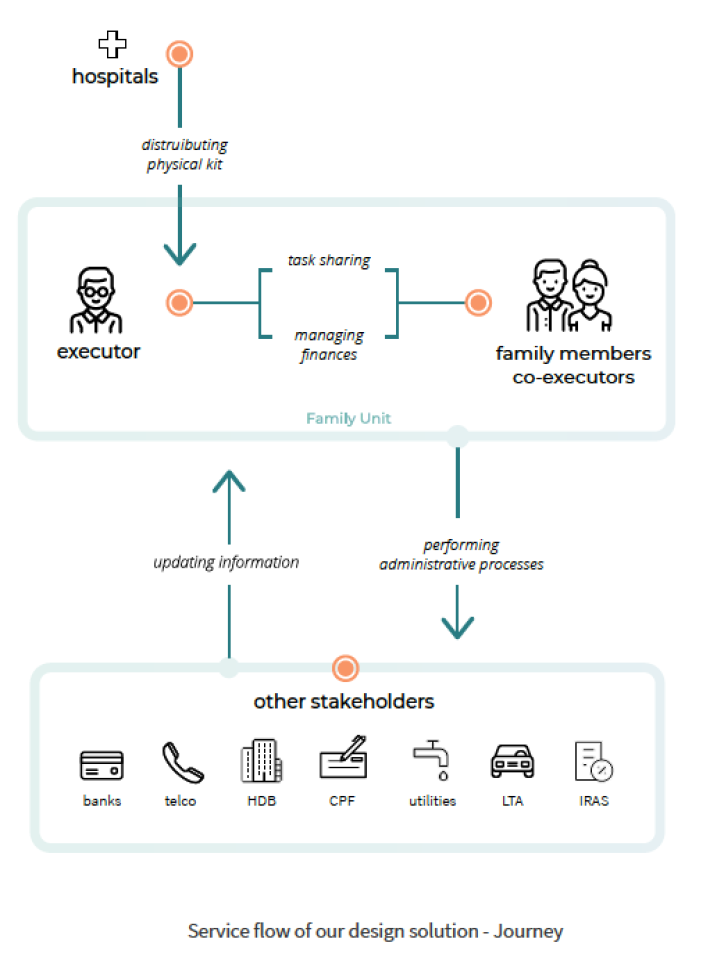

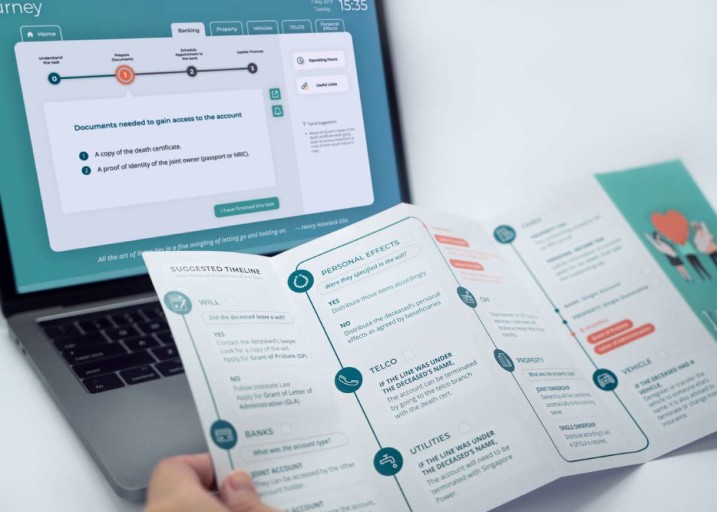

Therefore, our challenge was to create an efficient and seamless service of post-death settlements for citizens in Singapore, which would ultimately provide guidance and assurance for this responsibility during critical moments.

Share your thoughts

0 RepliesPlease login to comment