OUTPUTS

Client Benefits

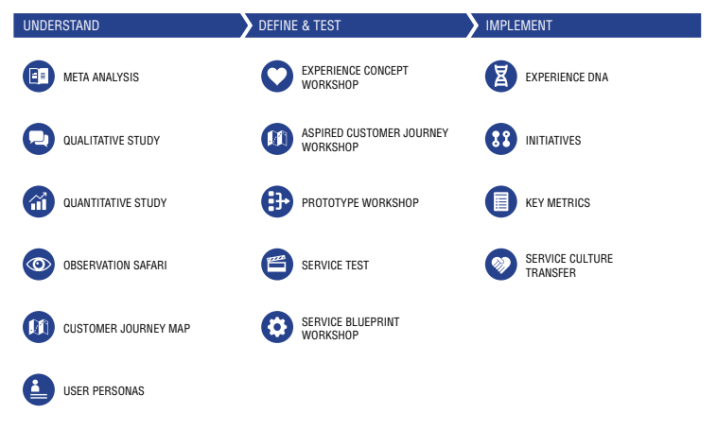

The client benefited from the design of a new service experience that is unique in the debt collection industry. The deliverables described in the process – such as Aspired Customer Journey, Service Blueprint, Experience DNA, KPI, and Initiatives – will help our client gradually roll-out the experience by creating new channels, training their employees and bringing the new experience to all branch offices.

On the other hand, the client also benefited from a process that installed a new user-centered culture. Our client was able to gain a deep understanding of their customer, creating within the organization through the use of rich user personas. They were given definitions – such as the Experience Concept and Attributes – to help guide future decision making, while co-creation helped break down silos to align different areas around the final user.

User Benefits

The new experience will benefit customers in several ways. On one hand, processes become more efficient, helping people save time through scheduled appointments, online negotiation, remote payment channels and new ways to resolve their issues with executives. Information is also given at key points to guide the user, such as a host for when they first arrive at the branch office or messages after each payment that show users their progress and recognizes their payment milestones.

On a deeper level, the service will create value by helping clients change their financial situation. The company will give access to financial education sources in the branch office waiting room and their website; executives also give personalized advice on financial administration, social benefits, and other ways that the customer can use to decrease their financial burden and make their spending more efficient. Considering that many of the users that are not making their payments are unemployed or don’t earn enough, the new experience will also guide people on how to improve their work condition, giving advice on unemployment benefits, sources on how to improve their CV and work interviews, inviting them to workshops to work with specialists on improving their job search, and connecting them to labor portals.

IMPACT

The impact of this project is going to be a radical change in the debts collectors industry at a national level. From collecting money to create a social value by helping end educating needed citizens. As the Debt collection agency depends directly of the bank state the impact of this project could touch the millions of Chileans that have an account in the bank. We hope that this new way of understanding debt collection also set a new standard on Chilean banking policies, defending clients values and needs.

Even if the level of satisfaction is already quite high, mostly because the clients in this situation doesn’t have big expectations on the service, around 75%, anyway we are sure that this project once implemented can have a strong impact on the quality of the agents' service and the satisfaction on information received. The satisfaction on the solution provided also will have an improvement due to a better understanding of clients banking restrictions for products and finally a high improvement on channels by incorporating many digital channels as a payment and solution method.

The impact on the organization was that Client Experience was understood as one of the major priorities in the organization at

an executive level. A board of experience was created to implement, measure, and align different areas of the organization, and tackle new experience challenges.

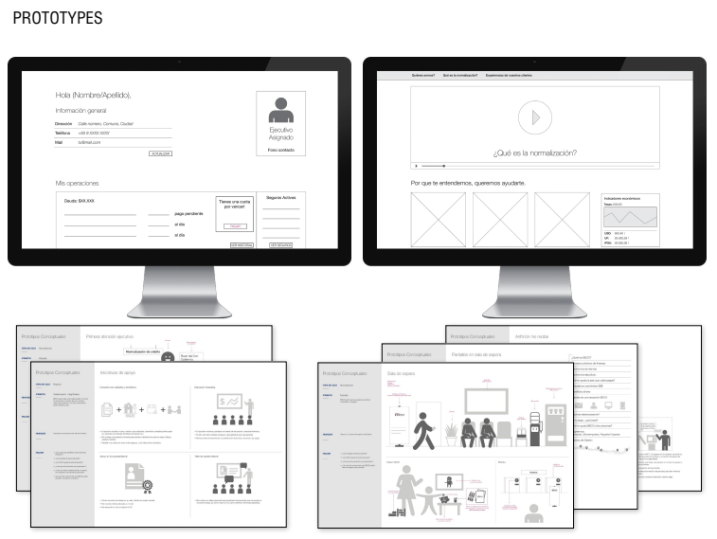

One of the impacts was also that the project helped them to understand the value of creating different contact and experience strategies for the different customer profiles they have in the organization. The organization started to understand how important is the relation, such as creating a link to understanding that they help people and not clients. They understood that it was key to listen y observe what client say. That decisions y actions on the organization must be centered on them. To be able to implement this change at a 100% they must think big but start acting at a small scale. Prototyping was the key of the project and for the implementation to be able to show result and measure the impact on investment.

The organization also learned that normalization, as they call the process to pay the debt, is not only oriented to results but also depends strongly on the experience that people lives throughout the process. Finally, the organization declares that there is a much bigger sensibility on different teams on the contact channels with clients. This is mostly driven by a strong purpose of their everyday work, due to the new experience definitions.

Share your thoughts

0 RepliesPlease login to comment